“Amazing, no mention of the new highs in gold except on the front page of today’s Financial Times. Is this a conspiracy of silence? Actually, the less said, the better. There’s nothing more powerful than a “silent and ignored bull market! – Richard Russell 10/07/09

Gold Soars To Another All-Time High!

Good day… And a Thunderin’ Thursday to you! It’s raining here in St. Louis, so, it must be Thursday! It’s a big night for yours truly, but I’ll talk about that at the end… We’ve got some big moves going on in the currencies and metals, so we had better get to it, and save the chit-chat for later, eh? But first, today is the funding deadline on our latest BRIC MarketSafe CD… We’ll have one more in November and then that’s it!

OK, front and center this morning, Gold has soared to another all-time high! When I turned on the screen this morning, Gold was flashing a great big $1,055 figure… WOW! But wait! OK, now that sounded like an infomercial… But wait! If you act now, you can get double the Ginsu knives! HA! OK, getting back to the original, but wait… Gold and Silver for that matter, aren’t the only risk assets moving higher this morning… All 16 of the countries that are deemed to be the biggest U.S. trading partners, have currencies that are taking liberties VS the dollar this morning…

Basically, it’s like this folks… We keep seeing signs that a global recovery is taking place, I mean, the Reserve Bank of Australia (RBA) even hiked rates this week for crying out loud! And… With those signs of recovery, come the feelings that global rates will be rising, as witnessed by the RBA this week, and with global rates rising, the yield differential to the dollar becomes even greater in favor of the non-dollar currencies.

This is quite evident, when you look out on the currency landscape and see that Aussie dollars (A$) are trading with a 90-cent handle… Brazilian reals are trading 36% higher VS the dollar since March 1st!

Why did I highlight those two currencies? Well, as has been well documented, the RBA already hiked rates and increased their rate differential to the dollar this week, with the thought that they would come back again in November for another rate hike… And Brazil? Yesterday, I saw a story flash across the screen that the Brazilian Central Bank Gov. is mentioning at least 200 BPS of rate hikes before he leaves office next year! Talk about increasing the rate / yield differential!

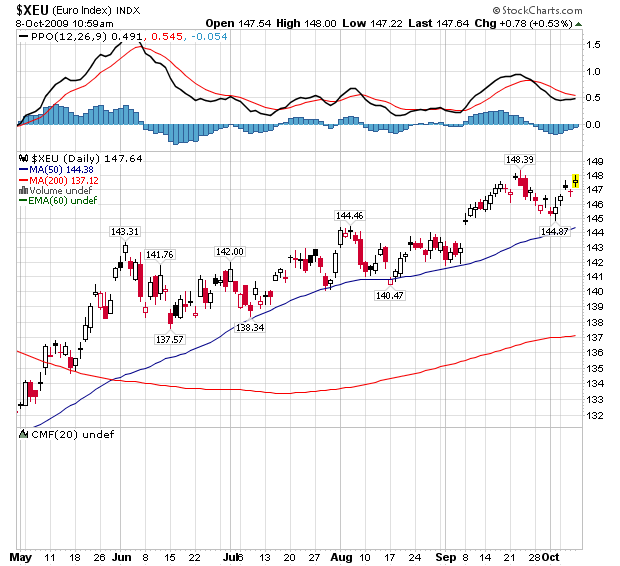

Yesterday, I talked to you about the euro, and explained why it had not participated with the other currencies’ assault on the dollar… Well, the Big Dog /euro got off the porch to stretch its legs and chase the dollar down the street a bit last night… The euro is trading with an eye toward 1.48…

Well, keeping with the theme that a global recovery is taking place, German Industrial Production rose in August 1.7% from a decline in July. As reported here about a month ago, Germany exited their recession in the 2nd QTR, posting a positive, albeit negligible, GDP… I expect their 3rd QTR to be a bit stronger, as they build on this nascent recovery.

The European Central Bank (ECB) meets this morning, in fact, they’re meeting as I write… I don’t expect the ECB to move rates, announce any quantitative easing, or anything like that… What I’m half expecting though is for ECB President, Trichet, to attempt to put a tourniquet around the dollar, to stop the bleeding… Hey! Nobody in the U.S. is fighting to keep the dollar strong, so somebody has to!

OK… I’ve explained this many times before, but for the new readers, it’s really something that needs to be understood… Look, the ECB and Trichet, know all too well that the U.S. has painted itself into a corner, and the dollar is getting punished for their actions… And, they understand that all they would have to do is talk glowingly about the euro and it would deep six the dollar in a heartbeat! But what good would that do? It’s far better to just keep the lips zipped shut, and watch a general, slow, depreciation of the dollar… So… The euro’s run to the high 1.47 handle this morning, could be at risk to what Trichet has to say… But remember folks, he’s just wrapping a tourniquet around the dollar, it’s not like he’s in love with the dollar and the fundamentals behind it!

Last night, I was doing some reading / research and came across a story that really piqued my interest… Here’s a snippet from the Bloomberg…

“Central banks are diversifying away from the dollar “more aggressively,” according to Barclays Plc, the world’s third-largest currency trader.

The dollar accounted for 37 percent of the $115 billion foreign reserves central banks amassed in the second quarter, after adjustment for exchange-rate changes during the period, compared with 52 percent in the euro, according to a Barclays analysis of data that the International Monetary Fund released on Sept. 30. That was the first time that the dollar’s share fell below 40 percent in the new accumulated foreign reserves of $100 billion or more since the euro’s 1999 debut.”

Remember, about a week or so ago, when I told you that the IMF’s currency report basically showed a move away from the dollar too…

HEY! IF CENTRAL BANKS ARE DIVERSIFYING, SHOULDN’T YOU BE DOING IT TOO?

OH! And there was this quote from Canada’s Finance Minister, Flaherty said…”We are all concerned about the U.S. dollar”…

And then there was this… Haven’t you heard about the guy, known as the Cheater? it seems every day now, you hear people say now, Look out for the cheater, make way for the fool-hearted clown, look out for the cheater, he’s gonna build you up just to let you down… Come on… We all know who I’m talking about, you know him, you love him… It’s U.S. Treasury Sec. Tim Geithner!

Yes, the man that was in charge the NY Fed, and oversaw the banks in that region, of which, most of them needed TARP money didn’t they? Any way… The thing I want to talk about is his latest statement about the dollar… Here’s Timmy! “officials recognize that the dollar’s important role in the system conveys special burdens and responsibilities on us, and we are going to do everything necessary to make sure we sustain confidence.”

Yeah, sure you are… How many Treasuries have you auctioned off this year? Something like $1.6 Trillion? Now, that will give everyone in the world a warm and fuzzy about the dollar’s future won’t it? NOT!

OK, I had better go on to something else before I get too wound up!

The Bank of England (BOE) is also meeting this morning… And after an awful set of economic reports in the past month, the BOE members are scratching their heads and wondering what to do next… They cut rates to the bone… They’ve bought toxic assets from financial institutions… They’ve nationalized a few companies that were about to go under… They spent money on stimulus packages… And they’ve implemented Quantitative Easing…

Sounds like the U.S. doesn’t it? I’ll tell you who else it sounds like… It sounds like Japan in the last decade… I hate to be the one to half to tell these dolts that none of this works! It just makes a laughing stock out of your Central Bank, and puts your currency on the slippery slope downward…

Oh, but not to worry, Tim Geithner is maintaining the confidence in the dollar… ( I guess no one told Canada’s Finance Minister, eh?)

Again, Chuck, go on to something else, and quit coming back to this!

Well… Earlier in the Pfennig this morning, I told you about the rise in the A$… I didn’t tell you that it was trading at a 14-month high, as it was reported that Australian employment surged 40,600 in September! With a print like this, I think that’s it’s almost a given now that the RBA comes back in November and hikes rates again!

Another currency at a 14-month high is the New Zealand dollar / kiwi… Remember how I’ve told you about the Reserve Bank of New Zealand (RBNZ) Gov. Bollard, and his penchant for jawboning kiwi lower? I despise him for these things, as a Central Banker, your job is to protect the value of your currency, not diss it!

Well, now Bollard has company… New Zealand Finance Minister, Bill English, has this to say… “We’re uncomfortable with it (kiwi) at this stage in the economic cycle.” You see, Mr. English is concerned that the economic recovery will be stamped out with a strong kiwi… Well, I’ve got a cure for you Mr. English… Tell Bollard and the boys over at the RBNZ not to raise interest rates, and that will do the trick! It’ll stop the speculation in its tracks! However, if the RBNZ does raise rates next month, then you have no one to blame but yourselves!

OK… Let’s get back to Gold, before we head to the recap and the Big Finish!

I did a video yesterday on Gold… And I talked about how you can go about your life without an inflation hedge in your back pocket and suffer the consequences of not only having your purchasing power reduced by the falling dollar, but having what dollars you have left eaten away by inflation… OR… you can get that inflation hedge… and put it away for a rainy day… or pull out to play it like a “Get Out of Jail Free Card” when inflation hits…

To recap… Gold has soared to another all-time high of $1,055 overnight. And the non-dollar currencies are all gaining VS the dollar on the thoughts that a global recovery will result in wider yield differentials in those currencies VS the dollar. A$ and kiwi have both traded at 14-month highs overnight… And… We could see some downside risk to the euro if ECB President Trichet decides to defend the dollar today after the ECB meeting this morning.

Currencies today 10/8/09: A$ .9050, kiwi .7398, C$ .9475, euro 1.4770, sterling 1.6060, Swiss .9745, rand 7.3440, krone 5.6545, SEK 6.9890, forint 182.75, zloty 2.8655, koruna 17.4375, RUB 29.60, yen 88.30, sing 1.39, HKD 7.75, INR 46.36, China 6.8260, pesos 13.31, BRL 1.7480, dollar index 76.03, Oil $70.23, 10-year 3.19%, Silver $17.84, and Gold… $1,055.08

That’s it for today… And for me this week, as Chris will have the conn on the Pfennig tomorrow. My beloved Cardinals took game one of the playoffs on the chin last night, leaving 14 runners on base… UGH! It’s a BIG night tonight for us here as the Cardinals play game two… The Hockey Blues have their home opener, and my beloved Missouri Tigers take on Big Bad Nebraska! I’m heading down to the game with oldest son, Andrew, and friends. It looks like we’re going to be soaked from the rain! UGH! I’ll talk to you again on Monday, God willing… So, have a Thunderin’ Thursday today, and a wonderful weekend ahead… Go Tigers!

Subscribe to Chucks FREE daily letter HERE.

Two decades ago, Chuck Butler embarked on his extensive career in foreign investments as the Director of Operations for the Fixed Income Division of the Mark Twain Bank. He oversaw the clearing and custody of all bond department trades and Mark Twain portfolio transactions.

In 1992, he became the Chief International Bond Trader and Director of Risk Management for the Mark Twain Bank, and was responsible for trading global bonds and currencies, as well and overall risk management. In that same year, Mr. Butler began composing his now decade-old daily currency market commentary, A Pfennig for Your Thoughts—a play on the American aphorism “a penny for your thoughts”(the pfennig is the Germany equivalent of a penny). The Pfennig started as some handwritten market notes and witty anecdotes circulated every morning to help traders stay on top of the economic, currency, and market happenings. Butler’s “Daily Pfennig,” as it is more commonly called today, has become a popular resource for currency investors and traders alike.

In 1999, Mr. Butler joined the team that launched EverBank as the Senior Vice President of EverBank World Markets. He oversees the trading desk and operations for over 12,000 individual and corporate clients, both in the United States and abroad, who look to EverBank for FDIC-insured World Currency Deposit Accounts, and Single Currency and Index CDs . Chuck is also a frequently quoted and respected analyst of the currency market; in 2003 and 2004, he has appeared on, was featured or quoted in, or referenced by: the Wall Street Journal, US News and World Report, CBS Market Watch, USA Today, CNNfn, the Chicago Tribune and many other publications.