From the January 2011 Hard Rock Analyst Journal

Preface Comments:

As usual, most of the first Journal issue of the year is given over to that annual exercise in masochism known as predictions for the year. We note several potential problems but, overall, we think the markets should be ok, and the sector we deal with will be more than ok.

There has been a small pullback to start the year as those who waiting for the next tax year to book profits have been putting stock in the market. We won’t be surprised if the pullback gets deeper before it’s over but we are not concerned about it.

We’re used to being contrarians. That might explain why we would be more comfortable if there was some correction in Venture companies and some of the base metals. Given we were about the only people around recommending both of those near the start of 2009 we think we’ve earned the right to be cautious.

Cautious is as far as it goes however. The exploration sector is as well funded as it’s ever been. After several thin years, a number of new discoveries arrived last year. All of those and anything near them will be getting lots of spending this year. News flow should be even heavier than 2010. There should be lots to trade once a bit of start of the year portfolio management has been gone through. We’re looking forward to it.

Follow Through – Part 1 (Economies and Equities)

We said at the start of 2010 that it would not be a literal repeat of 2009. We expected gains, but ones that were less dramatic than 2009. That largely came to pass in the markets, though there has been a recent shift in leadership. Metals performed far better than most thought they would. We were among the most optimistic but still found the scale of some of the gains a surprise. There are a lot of different areas we want to make New Year comments on so we’ll get right to it.

Major Economies:

As expected, developing economies accounted for most of the marginal growth in the world economy last year. We think that could be repeated again this year, though the difference in debtor/developing country growth rates could narrow.

The debtor economies (US, Euroland and Japan) muddled through another year as we thought they would. They didn’t put in a stellar performance but progress was steady, if slow. That is a victory of sorts given the widespread belief early in 2010 there would be a double dip recession. Few observers expect one in 2011.

Plenty of risks remain. There is much to be done before debtor economies are back to anything like pre-crisis normality. Growth rates should shift to a slightly higher level in 2011, while deleveraging continues.

The threat of sovereign default continues to hang over Euroland. This concern might ease but is not going away any time soon. The economic dislocations in many of the peripheral countries in Europe are too large, and there is still too much resistance to change for the picture to improve quickly.

That said, in most cases we think the fear of small country defaults is overblown. Not because they can’t happen, but because the cost is manageable, in most cases. That said, Portugal is the latest concern and its bond yields are climbing again.

This time the EU is trying to engineer a bailout before the market forces everyone’s hand. Portugal’s government is insisting the bailout is unnecessary, but that’s what governments always say before they agree to one. There would be market fallout from another bailout, but one at the scale of Portugal is not an end of the world scenario.

Weaker EU economies will continue to weigh the costs and benefits of leaving the Euro. The productivity gap between the PIIGS and the larger EU members is far larger than should exist within a currency union. It will be difficult Europe’s poorer countries to regain competitiveness without the ability to devalue their currency.

We’re not convinced any of them will leave. Richer Euro members will buy them off with continued assistance. Nonetheless, potential for exits and/or bailouts could weigh on the Euro through 2011. This may become an added source of “strength” for the US Dollar. That said Europe’s larger markets have been strengthening. Germany continues to excel at high value manufacturing and France has recently seen better PMI numbers.

US stats are also improving steadily. Sales through November and early December were stronger than anticipated. Purchasing Manager Indices (both Manufacturing and Service) and capital spending have greatly exceeded expectations. Recent US optimism is tied to bi-partisan agreement to extend Bush era tax cuts and cut payroll taxes. The stimulus effect of those cuts has many raising their growth targets for the US this year. We think the acceleration is real enough. The real question is sustainability after this initial flush of positive sentiment.

Jobs are the indicator that means the most and the key to a higher growth track. The market was disappointed by a lower than expected December jobs number in the US. However, the October and November numbers were revised upwards substantially. Continual upward revision in these sorts of statistics is common when an economy is shifting to a higher gear.

The numbers are still not strong. There is little danger the US Fed will either raise rates or back off on QEII any time soon. That should contain over enthusiasm about the US Dollar.

China’s leaders are starting to worry about inflation, though not enough to let the Yuan rise, which is the simplest solution. Inflation has only risen to the 5-6% level so far, and much of that are food prices. Since Beijing’s mercantilist leaders seem unwilling to use currency appreciation to stem inflation traders worry they will overdo a tightening round.

Several increases in bank reserve ratios did little to cool the economy. There have now been two interest rate increases in quick succession and more are expected if those don’t work quickly. Beijing has proven more adept at adjusting its growth rate than most, but do seem to be tapping the brakes too lightly right now. Markets everywhere react to events in China now. Signs of continued overheating in China can be expected to hit markets and commodities.

India and Brazil both had moderation in their growth rates, though they were still strong. Indonesia, the “other I” in BRIIC, came through the Great Recession in good shape. It’s not growing at the rate of the other Developing country leaders yet but the growth rate is accelerating. Indonesia still relatively poor, but its large population means it will matter more to the world economy soon. It’s already starting to attract the levels of inbound investment that helped China and India take off (see table above).

Equities & Inflation

Yahoo’s relative performance chart for 2010 for the German DAX, US S&P, Indian Sensex, Brazilian Bovespa, Canadian TSX and Shanghai exchanges.

Yahoo’s relative performance chart for 2010 for the German DAX, US S&P, Indian Sensex, Brazilian Bovespa, Canadian TSX and Shanghai exchanges.

The table above shows the main index changes in a number of the world’s important bourses through 2010 and 2009. Several of these also appear on the relative performance chart on the next page. Developing country bourses that massively outperformed developed country exchanges in 2009 lagged some in 2010. Some of this was simple mean revision after a great year. But, the lower returns also reflect concern these economies will increasingly struggle to contain inflation.

The flood of liquidity that the US Fed and ECB have been generating hasn’t done much to boost inflation at home but it’s causing headaches elsewhere. Large capital inflows combined with soft commodity (i.e. food) price inflation has been raising inflation rates across most of the developing world. This has created a tough problem for their central bankers since inflation has been accompanied by strengthening home currencies in most cases.

The classic inflation solution of fiscal tightening and higher interest rates further boost these rising currencies. Nonetheless, Brazil, India, Indonesia and China have all raised rates recently to tackle inflation. More increases are expected this year. Real (inflation adjusted) interest rates are still low, but the markets are not reacting well to the potential for a string of rate increases.

Most of these countries can be expected to press Beijing to let the Yuan rise to help reduce some of the world’s fiscal imbalances. Other Asian countries that are approaching lift off as low wage manufacturing shifts from China to them will add their voices. This pressing may however be gentle as China is becoming as important to Asian exporters as it has been to western importers for over a decade.

Foreign currency reserves in China recently surpassed $2.85 trillion. This will add to the pressure on Beijing. A stronger Yuan would make some lawmakers in Washington happy, until they start getting the same message about the Dollar.

Concerns about fiscal tightening led to a year over year loss on Shanghai, and a flat market in Brazil. India fared better, but overall the average developing country gain was lower, while developed country bourses caught up. Some of the weakness in developing country indices was driven by greater optimism in developed markets after QEII became official and the US tax compromise was reached. Increased money flow into developed markets was partially at the expense of “emerging markets.”

After months of worries about double dips and European defaults the developed markets rose through the last third of the year. Loose fiscal policy was a big driver, but many multinationals that dominate first world stock indices had good years. Some of this was cost cutting that will be tough to repeat, but not all of it. Many large companies managed to generate good top line growth.

It won’t be easy to replicate those gains unless the higher growth rate for the G7 sticks through the whole year. Earnings should be decent, but much of that is priced in. We expect gains in the single digits for most developed country exchanges, with room for significant turbulence if there are bailouts in Europe.

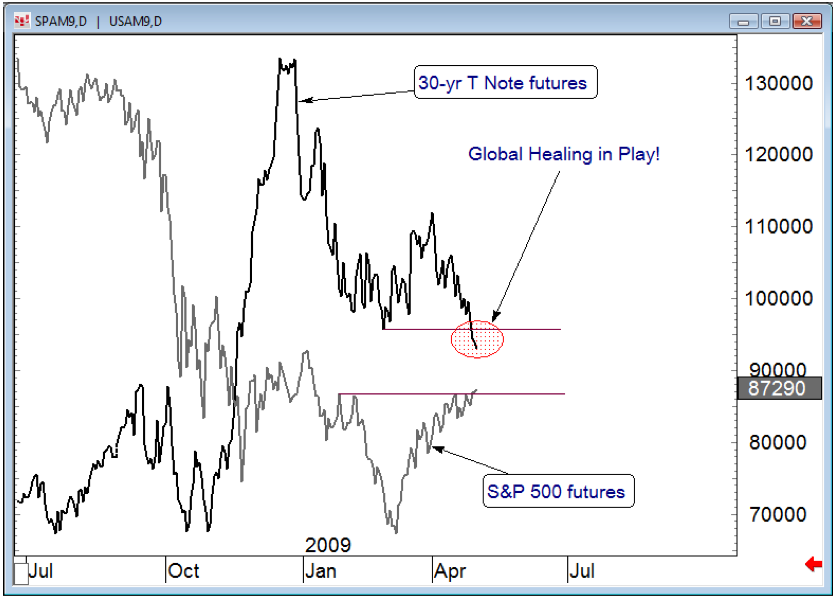

One thing that could improve returns would be a rollover in the bond markets, if it’s due to greater optimism. Notwithstanding high levels of investor bullishness, there are still vast amounts of money in bond funds.

A sentiment swing that moved an appreciable amount of that money back to equities could lead to another P/E ratio expansion. It’s not something we’d bet on but it’s not outside the realm of possibility. For our purposes, a market stable enough to allow for gains from the sector we focus on is good enough.

Resource Stocks:

Now that was a rally! The chart of the TSXV Index on the next page suggests just how remarkable the move has been these past few months. Bottom to top, the Venture index climbed 72% in the space of six months, one of the most impressive rallies you’re likely to see. The rally was all the more impressive given the strong trading volume that accompanied it.

Resource companies took full advantage of the move. Juniors raised billions of dollars, with the largest funding coming toward the end of the year. Much of this stock will come off escrow over the next 2-3 months. Since most of this placement stock it well in the money profits taking is to be expected.

This could lead to a period of consolidation that would be healthy after a long one way streak. We’re not assuming a large drop, unless metal prices really came off. Volumes continue to be high and sellers have had little trouble finding bids.

A lot of last year’s gain was driven by discoveries, which make for sustainable rallies. Companies with strong management and targets are mostly cashed up. Even if larger markets are flat the ingredients to generate news flow in the resource sector are already in place.

After a potentially rocky start, resources will continue to be a favored market sector through 2011. As long as there are companies generating new discoveries and expanding resources the Venture exchange should have room for a spring rally. This is still a secular bull market that continues to broaden its audience.

It’s a secular bull market for metals and resources. We’ve been saying that for ten years. And we’ve been right. HRA initiated coverage on 19 companies since early 2009 – the average gain to January 12, 2011 is 309%!

The HRA – Journal, HRA-Dispatch and HRA- Special Delivery are independent publications produced and distributed by Stockwork Consulting Ltd, which is committed to providing timely and factual analysis of junior mining, resource, and other venture capital companies. Companies are chosen on the basis of a speculative potential for significant upside gains resulting from asset-base expansion. These are generally high-risk securities, and opinions contained herein are time and market sensitive. No statement or expression of opinion, or any other matter herein, directly or indirectly, is an offer, solicitation or recommendation to buy or sell any securities mentioned. While we believe all sources of information to be factual and reliable we in no way represent or guarantee the accuracy thereof, nor of the statements made herein. We do not receive or request compensation in any form in order to feature companies in these publications. We may, or may not, own securities and/or options to acquire securities of the companies mentioned herein. This document is protected by the copyright laws of Canada and the U.S. and may not be reproduced in any form for other than for personal use without the prior written consent of the publisher. This document may be quoted, in context, provided proper credit is given. ©2010 Stockwork Consulting Ltd. All Rights Reserved. Published by Stockwork Consulting Ltd.Box 85909, Phoenix AZ , 85071 Toll Free 1-877-528-3958 hra@publishers mgmt.com http://www.hraadvisory.com