Once again the Santa Claus rally has been profitable. Historically, the Santa Claus rally extends into this week and is followed by at least a shallow correction. Look for history to repeat. Use strength this week to take profits of seasonal trades initiated near the beginning of October.

The TSX Composite Index added 28.42 points (0.24%) last week, but down 11.1% for 2011. Intermediate trend is down. Support is at 10,848.19 and resistance is at 12,542.58. The Index trades below its 200 day moving average and is testing its 50 day moving average. Short term momentum indicators continue to recover from oversold levels. Strength relative to the S&P 500 Index remains negative.

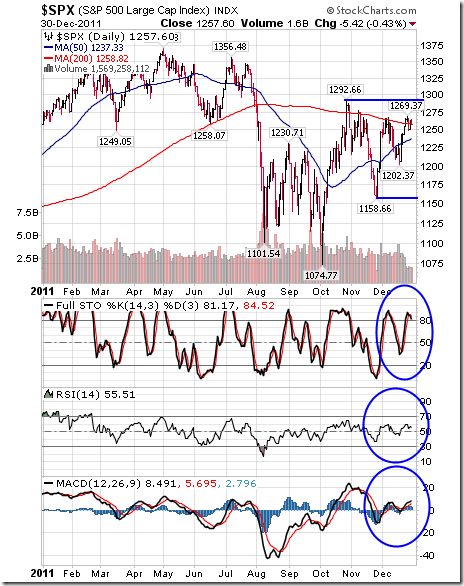

The S&P 500 Index eased 7.73 points (0.61%) last week, but was unchanged in 2011. Intermediate trend is neutral. Support is at 1,158.66 and resistance is at 1,292.66. The Index trades above its 50 day moving average, but slipped below its 200 day moving average on Friday. Short term momentum indicators are overbought and are showing early signs of peaking.

The U.S. Dollar added 0.25 last week to reach a 13 month high. Intermediate trend is up. The Dollar remains well above its 50 and 200 day moving averages. Short term momentum indicators remain overbought.

Crude Oil slipped $0.60 (0.60%) last week. Intermediate trend is up. Support is at $92.52 and resistance is at $103.37. Crude completed a “Golden Cross” last week. Short term momentum indicators are overbought and showing early signs of rolling over. Seasonality turns positive in February.

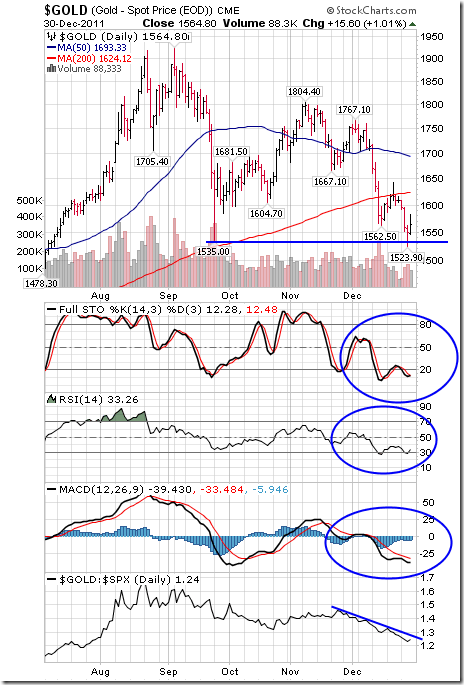

Gold fell $44.70 (2.78%) last week and briefly broke support at $1,535.00. Nice bounce late on Thursday and continuing on Friday! Short term momentum indicators are oversold and may be showing early signs of bottoming. Strength relative to the S&P 500 Index remains negative.

…go HERE to Don’s Tech Talk site for the 40+ more charts to view as well as other interesting articles posted today.

About Don Vialoux

Don Vialoux has 37 years of experience in the Investment Industry. He is a past president of the Canadian Society of Technical Analysts (www.csta.org) and a former technical analyst at RBC Investments. Don earned his Chartered Market Technician (CMT) designation from the Market Technician Association in 1995. His CMT paper entitled “Seasonality in Canadian Equity Markets” was published in the Spring-Summer 1996 edition of the MTA Journal. Don also has extensive experience with Exchange Traded Funds (also know as Index Participation Units) as well as conservative option strategies. In 1990 he wrote a report that was released in the International Federation of Technical Analyst Journal entitled “Profiting from a Combination of Technical and Fundamental Analysis”. The report introduced ” The Eight Phases of the Stock Market Cycle”, an investment concept that continues to identify profitable entry and exit points for North American equity markets. He is currently a member of the Toronto Society of Fundamental Analyst’s Derivatives Committee. Now he is the author of a daily letter on equity markets available free on the internet. The reports can be accessed daily right here at www.dvtechtalk.com.