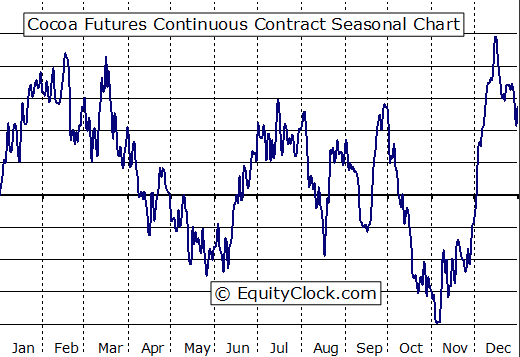

According to EquityClock.com, the average optimal holding period for Cocoa futures is from October 22nd to February 16th. Average gain over the last ten periods was 13.9 percent. The trade was profitable nine of the last ten years.

Cocoa has a history of moving higher between November and March. What are prospects this year?

Gains revolve around the production and sale of chocolate over a number of holiday periods, including Halloween, U.S. Thanksgiving, Christmas, and Valentine’s Day. The trade concludes prior to the Easter holiday. As demand grows for chocolate in the late Fall and Winter, so too does the price of cocoa when companies such as Hershey and Cadbury are major buyers. The period of seasonal strength also corresponds with the timeframe when the larger of the two annual crops begins to ripen and harvest yields become known. A smaller harvest also takes place during the period of seasonal weakness from April to June.

The current outlook for Cocoa is mixed. The National Confectioners Association recently reported that Cocoa Production in North America grew 3.4 percent in the Third Quarter to 124,621 metric tons due to increased demand. However, supply is expected to remain plentiful due to favourable weather conditions in the 2011 growing season.

On the charts, Cocoa has an improving technical profile. The Dow Jones-UBS Cocoa Sub-index is rebounding from oversold territory according to a number of technical indicators, including MACD, RSI, and Stochastics. The benchmark remains in an intermediate downtrend, below both 50 and 200-day moving averages. Support is indicated at $31 and resistance is prominent at $35. Strength relative to the S&P 500 Index is showing early signs of recovery.

Aside from purchasing Cocoa Futures Contracts, investors can gain exposure through the iPath Dow Jones-UBS Cocoa Sub-index Total Return ETN (NIB $37.70), an unleveraged investment based on short term notes and cocoa futures contracts.

Preferred strategy is to accumulate positions in Cocoa for a trade during the current period of seasonal strength. Expected US dollar weakness during the current period also could add to returns.

Don and Jon Vialoux are the authors of free daily reports on equity markets, sectors, commodities and Exchange Traded Funds. They also are research analysts for JovInvestment Management Inc. All of the views expressed herein are their

personal views although they may be reflected in positions or transactions

in the various client portfolios managed by JovInvestment. JovInvestment is

the investment manager for the Horizons family of ETFs. Daily reports are

available at http://www.timingthemarket.ca/ and http://www.equityclock.com