Technical, fundamental and seasonal influences point to another volatile period for equity markets around the world this week. Economically sensitive sectors are following their seasonal patterns. However, most sectors currently are short term overbought after huge moves since October 4th. Preferred strategy is to accumulate economically sensitive equities and related ETFs on short term weakness, particularly if they benefit from favourable seasonal influences.

Economic News Items: 13 This Week listed by Don

Click HERE toview 44+Charts Don has Examined,

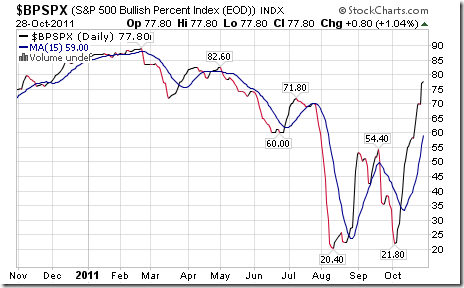

Bullish Percent Index for S&P 500 stocks jumped last week from 63.40% to 77.80% and remained above its 15 day moving average. The Index has moved from slightly intermediate overbought to significantly intermediate overbought.

The S&P 500 Index gained 46.83 points (3.78%) last week. Intermediate trend is neutral. Support is at 1,074.77. Resistance is at 1,356.48. The Index moved above its 200 day moving average on Thursday. Short term momentum indicators are overbought, but have yet to show signs of peaking. Gain since its October 4th low is 19.6%.

Bullish Percent Index for TSX stocks increased last week from 42.64% to 49.81% and remained above its 15 day moving average. The Index has recovered to an intermediate neutral level.

The TSX Composite Index added 570.02 points (4.77%) last week. Intermediate trend is down. The Index moved above its 50 day moving average on Thursday, but remains below its 200 day moving average. Support is at 10,848.19. Resistance is at 12,798.53. Short term momentum indicators are overbought, but have yet to show signs of peaking. Strength relative to the S&P 500 Index remains negative. Gain from its October 4th low is 15.4%.

Click HERE toview 44+Charts Don has Examined