Todd Market Forecast for Monday August 13, 2011

Available Mon- Friday after 6:00 P.M. Eastern, 3:00 Pacific.

DOW + 214 on 2500 net advances

NASDAQ COMP + 47 on 1600 net advances

SHORT TERM TREND Bullish

INTERMEDIATE TERM TREND Bullish

GOLD: Gold was up nicely. The fear factor wasn’t at work, but the lower greenback did have an effect. We’re still bearish, but we’ll see how things develop.

BONDS: Bonds fell back a bit. The lessening of the fear factor diminished the rush to safety.

THE REST: The dollar was down sharply. Silver copper and crude oil were all marginally higher. The euro rose sharply, I suppose in anticipation of great things from the meeting tomorrow between Sarkozy and Merkel.

BOTTOM LINE:

Our intermediate term systems are on a buy signal.

System 2 traders are in cash. Stay there on Thursday.

NEWS AND FUNDAMENTALS:

The Empire State Manufacturing Survey came in at -7.72, less than the consensus +1.0. The Housing Market Index was 15, in line with expectations. On Tuesday we get industrial production and housing starts.

We’re on a sell for bonds as of August 11.

We’re on a buy for the dollar and a sell for the euro as of August 4.

We’re on a sell for gold as of August 11.

We’re on a sell for silver as of August 11.

We’re on a buy for crude oil as of August 11.

We’re on a buy for copper as of August 11.

We are long term bullish for all major world markets, including those of the U.S., Britain, Canada, Germany, France and Japan.

INDICATOR PARAMETERS

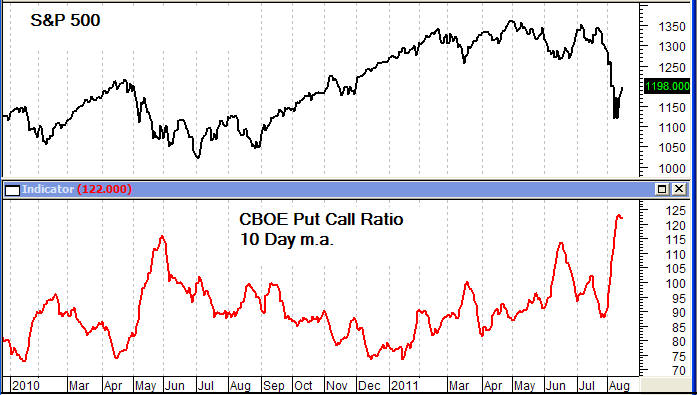

Monetary conditions (+2 means the Fed is actively dropping rates; +1 means a bias toward easing. 0 means neutral, -1 means a bias toward tightening, -2 means actively raising rates). RSI (30 or below is oversold, 80 or above is overbought). McClellan Oscillator ( minus 100 is oversold. Plus 100 is overbought). Composite Gauge (5 or below is negative, 13 or above is positive). Composite Gauge five day m.a. (8.0 or below is overbought. 13.0 or above is oversold). CBOE Put Call Ratio ( Below .80 is a negative. Above 1.00 is a positive). Volatility Index, VIX (low teens bearish, high twenties bullish), VIX % single day change. + 5 or greater bullish. -5 or less, bearish. Advances minus declines three day m.a.( +500 is bearish. – 500 is bullish). Supply Demand 5 day m.a. (.45 or below is a positive. .80 or above is a negative).

No guarantees are made. Traders can and do lose money. The publisher may take positions in recommended securities.

Stephen Todd – A Short Biography

Since 1984, the editor and publisher of the Todd Market Forecast, a monthly newsletter with emphasis on the stock market, but also with sections about gold, silver, copper, oil, currencies and bonds.

Steve spent a number of years as an engineer in a steel mill before becoming a stock broker with a number of Firms, including E.F. Hutton, Bache and Paine Webber.

He has published articles on the economy and the stock market in the following publications: Barron’s, Stock Market Magazine, Futures Magazine, The National Educator and others.

His stock market commentary is heard on CNBC, Bloomberg, Associated Press Radio, Business Radio Network, CKNW in Vancouver, British Columbia, KFWB, Los Angeles and ROBTV in Toronto, Ontario Canada.