It continues to be hard to focus on markets with all the suffering from Japan shown everywhere. Americans have much to learn from how Japan as a society acts in horrific times. I’m afraid we won’t come remotely close when you know what hits the fan here and sticks.

I’ve long spoken about the “Don’t Worry, Be Happy” crowd that reigns on Wall Street and many within the media that reports (and makes their living off it) on it. They were out in full force on TOUT-TV and wherever they could be heard, telling how this tragedy shouldn’t have any lasting effect on our stock market and how well it has done given the news. I would fully expect if Japan was literally wiped out, one of these “Talking Heads” would come on and claim it’s bullish since now they can’t sell their U.S. debt and their debt couldn’t be paid. The events in Japan are going to have long lasting, mostly negative implications whether there’s a real nuclear meltdown or not.

Based on the U.S. close and the big bounce underway in Japan as I type, we can see U.S. stocks rise sharply at least at the outset tomorrow. There’s been serious technical damage to the market. I also urge you to watch this video and the notation of record complacency that’s a screaming bearish indicator.

I would use any strong rallies to build up a chicken coup. As bad as Japan is at the moment, the knockout punch IMHO is going to be more and sustained troubles in the Middle East coming back into the headlines, and the belief of a day of reckoning coming to the U.S. begins to catch on in earnest.

It’s tempting to go short U.S. bonds here but I sooner just continue to avoid them, period.

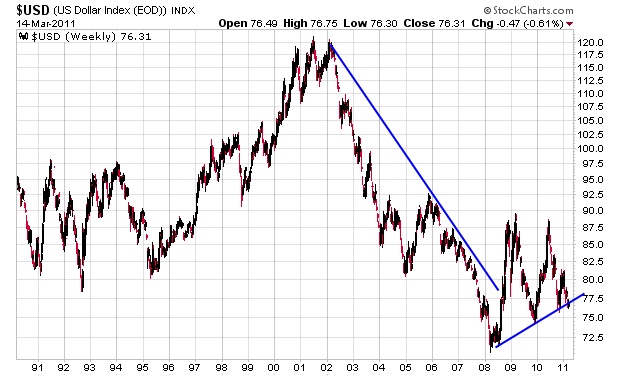

Look for gold and silver to bounce back in fairly short order. The usual geopolitical concerns are likely to get an added push with the U.S. Dollar breaking down. It should have flew but didn’t.

I’ve written for weeks now about a day of reckoning coming to America. Like Jesus says in the Bible, only the Father knows when He’s coming again and we shouldn’t waste time speculating on End Times. I don’t know the year or day when America finally begins to pay in earnest and am not trying to time it. However, much of the evidence has been shared by me and others. Below is taken from an excellent piece from The Gathering Storm:

- The two and one half years since September 2008 have set the stage for a far worse catastrophe. The Obama administration jammed an $800 billion pork-filled stimulus bill down the throats of America, along with home buyer tax credits, loan modification programs, and a healthcare plan that will crush small businesses. The politicians, government bureaucrats, and mainstream media corporate mouthpieces proclaim that their wise and prompt actions averted a Second Great Depression. The government solutions used to “stabilize” the situation have wrought unintended consequences and planted the seeds of further pain and suffering to come. A summary of what has happened in the last few years is in order:

- On September 18, 2008, the National Debt stood at $9.66 trillion. Today it stands at $14.16 trillion, a 47% increase in 2 1/2 years.

- The country is running $1.5 trillion annual deficits and will continue to do so for the foreseeable future.

- The States are running cumulative budget deficits of $130 billion in FY11 and expect deficits of $112 billion in FY12. This is leading to conflicts with unions, higher taxes and mass layoffs of government workers.

- The working age population has risen by 5 million, while the number of employed Americans has declined by 6.5 million. The true unemployment rate http://www.shadowstats.com/alternate_data/unemployment-charts has risen from 12% to 22%.

- In September 2008, there were 30.8 million Americans on food stamps. Today there are 44 million Americans on food stamps (14% of the U.S. population), a 43% increase in 2 1/2 years. The annual cost has risen by $37 billion, a 100% increase in 2 1/2 years.

- Real inflation http://www.shadowstats.com/alternate_data/inflation-charts bottomed at 5% in early 2009, but has accelerated to 9% today, with further increases baked in the cake.

- Gasoline prices bottomed out at $1.61 per gallon in January 2009 and have risen to $3.54 per gallon today, a 120% increase in just over two years.

- Households have lost $6.3 trillion of real estate-related wealth since the peak of the housing market. Home prices have fallen for six straight months.

- Almost 3 million homes have been lost to foreclosure since 2007.

- There are 11.1 million households, or 23.1% of all mortgaged homes, underwater on their mortgages today, with rates above 50% in Nevada, Arizona, California, and Michigan.

- Fannie Mae and Freddie Mac were taken over by the US government and have lost $170 billion of taxpayer funds so far. Losses are expected to reach $400 billion. Along with the FHA, they continue to prop up a dead housing market with more bad loans.

- The Federal Reserve balance sheet in September 2008 consisted of $895 billion of US Treasury bonds. Today it totals $2.55 trillion of toxic mortgages bought from Wall Street banks and Treasury bonds being bought under QE2.

- The Federal Reserve and the Treasury Dept. intimidated the FASB into allowing Wall Street banks to account for worthless mortgage and real estate loans as fully collectible. Magically, insolvent banks became solvent – on paper.

- The Dow Jones was 11,700 in late August 2008 and today stands at 12,000. The Dow has risen 84% from its March 2009 low. The top 1% wealthiest Americans own 40% of all the stocks in America, so they are feeling much better.

- In late 2007, a risk-averse senior citizen could get a 5% return on a 6-month CD. Today, after two years of no increases in their Social Security payments, a senior citizen can “earn” .38% on a 6-month CD.

- The Federal Reserve lowered interest rates to 0% in order to allow the Wall Street banks to borrow for free and earn billions without risk.

- Over 300 smaller banks have been closed by the FDIC, with losses exceeding $50 billion. There are another 900 banks on the verge of insolvency, with estimated future losses of $100 billion.

- The Federal Reserve initiated QE2 in November 2010, purchasing $70 billion per month of Treasury bonds and attempting to create a stock market rally. They have succeeded in creating a tsunami of energy, food, and commodity price inflation across the globe, sparking revolutions among the desperately poor in the Middle East.

- Wall Street banks “earned” record profits of $19 billion in 2010 after nearly destroying the worldwide financial system in 2008 and raping the American taxpayer in 2009.

- No Wall Street executive has been prosecuted for the fraudulent actions committed by their banks.

- Wall Street banks handed out $43.3 billion in bonuses in 2009/2010 for a job well done. The average Wall Street employee received a $128,000 bonus in 2010. In 2008, the year they crashed the financial system, they still doled out $17.6 billion in bonuses.

- The median household income in 2007 was $52,163. Today the median household income is $46,326, an 11% decline in three years. Real average weekly earnings are lower today than they were in 1971.

- It is clear from the list above that the oligarchic players that wield the power in this country have chosen to prop up their tottering structure of debt-created-wealth on the backs of the working middle class. The people who have been screwed and continue to be screwed are growing angry and distrustful, as anticipated by Strauss & Howe:

“But as the Crisis mood congeals, people will come to the jarring realization that they have grown helplessly dependent on a teetering edifice of anonymous transactions and paper guarantees. Many Americans won’t know where their savings are, who their employer is, what their pension is, or how their government works. The era will have left the financial world arbitraged and tentacled: Debtors won’t know who holds their notes, homeowners who owns their mortgages, and shareholders who runs their equities – and vice versa.”