The severe problems that the world economy and financial system have experienced in the last couple of years will seem like a walk in the park compared to what will happen in the next couple of years.

For the investors who haven’t yet protected themselves, let us tell you that you are very lucky. You are lucky that you have been given yet one more chance to protect yourself. But let us be very clear, you have a very short time to put your house in order. Because during the month of November the events that we outlined in our Newsletter “A Shocking Fall” are going to start to unfold.

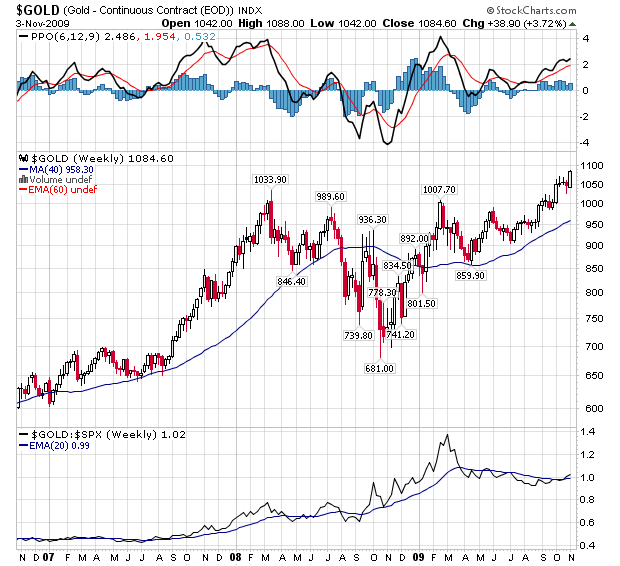

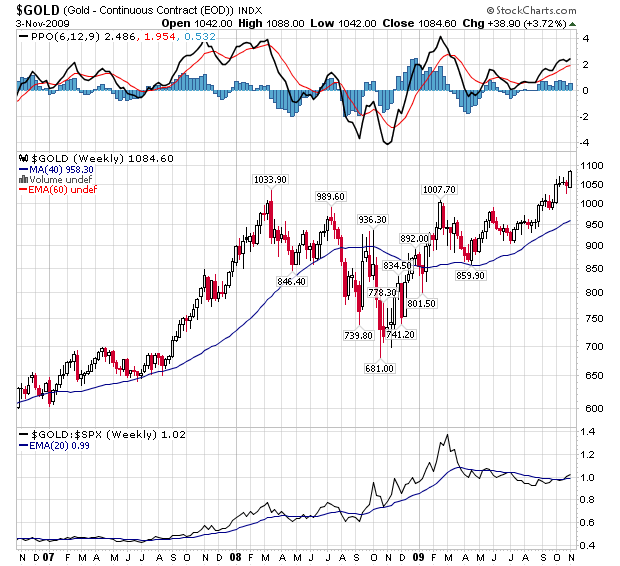

Dollar down and Gold up

Starting in November, we are likely to see the dollar falling precipitously and stockmarkets turning down after this bear market correction. We will see the bond market falling and especially long term interest rates going up. And most importantly gold will start to move up very strongly.

We have since 2002 advised our investors to protect themselves by buying physical gold and store it outside the banking system. Gold has since gained more than 250%. Also, in the last ten years the Dow Jones has moved down 80% against gold. Most world stockmarkets have had similar falls against gold. So in real terms the stockmarket has been a very poor investment. We expect the Dow to fall another 90% against gold in the next few years.

The party is over

Earlier this year we said that a 50% correction is totally normal in a bear market and that would take the Dow to 10,300 which could happen by early November. Stockmarket investors have been given an incredible gift in the last seven months but the party is now over. Most investors will not realise this until it is too late. They will hang on to their shares for a long time yet and follow the market most of the way down. In our view, the only stocks worth holding are precious metals stocks which are grossly undervalued and will benefit from a very strong rise in gold.

The next few years will be devastating for the world economy, for the financial system and for private lives. We have outlined this scenario in our newsletters and commentaries for a long time.

The majority of people are short sighted and believe the economy has improved because governments have printed trillions of Dollars, Pounds, Euros etc that they call money. But let us be very clear, you can’t abolish poverty by printing paper and you can’t solve the world’s enormous debt problem by exacerbating it. These debts will never be repaid with normal money, not today and not tomorrow – NEVER!

Still time for protection

In the next few weeks until some time in November, investors can still protect themselves by selling their stockmarket investments and buying gold at reasonable prices. Gold at $1,050-60 will be seen as the bargain of a lifetime in the next 12-24 months. But remember that the main reason for buying gold is to protect yourself from the destruction of paper money and assets that will take place in the next few years. Many countries, including the US and the UK will have a hyperinflationary depression which will change the face of the world as we know it today.

So physical gold (and silver) stored outside the banking system is your best protection.

Matterhorn Asset Management has set up a separate Gold Division called GoldSwitzerland (www.goldswitzerland.com) in order for investors to purchase physical gold at very competitive prices and store it in their own name in Zurich, Switzerland outside the banking system and with personal access to their own gold bars.

GoldSwitzerland is the gold investment division of Matterhorn Asset Management AG, a Swiss asset management company specialising in wealth preservation with particular emphasis on precious metals. MAM is part of the Aquila Group which is the largest independent asset management group in Switzerland. The parent company, Aquila Investment AG, is regulated by the Swiss Federal Banking Commission.

Max Cotting is Chairman of Matterhorn and also CEO of the Aquila group which he founded in 1999. Previously he was CEO of Bank Heusser in Basel and a member of the executive committee of Clariden Bank Group in Zurich.

Egon von Greyerz (EvG) is the Founder and Managing Partner of Matterhorn Asset Management AG and Gold Switzerland. EvG started his working life in Geneva as a banker and thereafter spent 17 years as Finance Director and Vice-Chairman of Dixons Group (DSG International Plc) , the UK’s largest electronic and electrical retailer.

Since the 1990s Egon von Greyerz has been actively involved with financial investment activities including Mergers and Acquisitions and Asset allocation consultancy for private family funds. This led to the creation of Matterhorn Asset Management as the primary verhicle for asset management based on wealth preservation principles. The Gold Switzerland division was created to facilitate the buying and storage of physical gold for both private and business investors.

Pricewaterhouse Coopers are the auditors of Matterhorn and Goldswitzerland.